The rapid spread of COVID-19 presents significant challenges around the world. In addition to the human impact, there is a considerable commercial effect being felt. Governments have adopted a wide range of containment measures, some of which have resulted in the shutdown of manufacturing, as well as labor disruption through enforced isolation, travel bans and border controls across the world. There is potential for a significant dent to global consumption and more.

Covid-19 is altering the world of logistics

Apr 21, 2020 4:04:00 PM / by Gulf News posted in Industry News, April 2020

Coronavirus COVID-19 wipes $50 billion off global exports in February alone, as IMF pledges support for vulnerable nations

Apr 21, 2020 3:56:19 PM / by UN News posted in Industry News, April 2020

The extent of the damage to the global economy caused by novel coronavirus COVID-19 moved further into focus when UN economists announced a likely $50 billion drop in worldwide manufacturing exports in February alone.

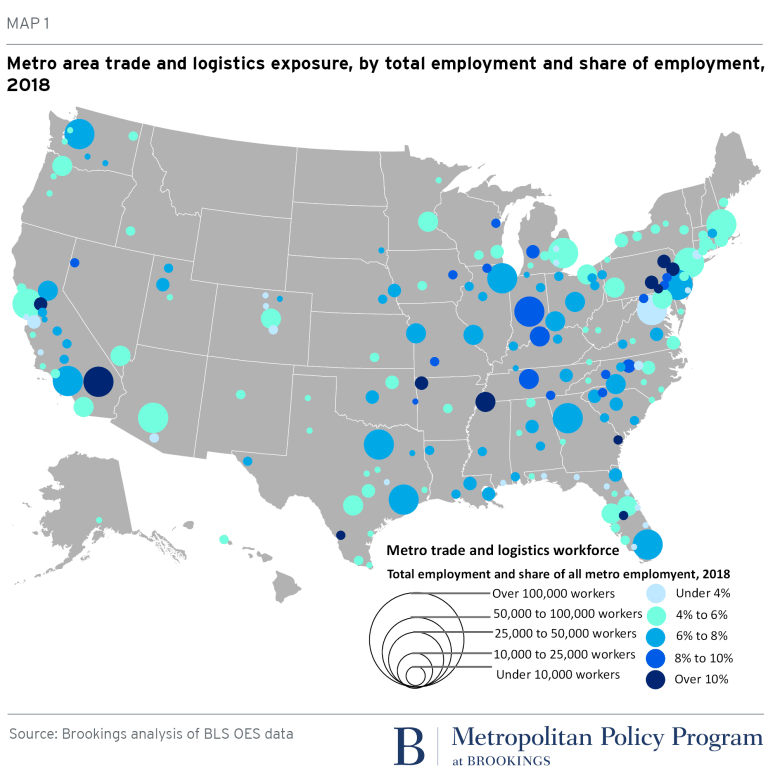

COVID-19 is hurting many industries and workers, but could it help trade and logistics?

Apr 21, 2020 3:51:27 PM / by Brookings Institute posted in Industry News, April 2020

From the beginning, COVID-19 has disrupted how people and places get goods.

The immediate disruptions were obvious and widespread: hand sanitizer in short

supply, nonexistent toilet paper, and empty grocery store shelves. The next

disruptions, however, are just beginning to unfold as businesses, consumers, shippers, and

others adapt to new demands throughout our global supply chains and infrastructure

networks.

Trade Shifts in the Time of Coronavirus

Apr 21, 2020 3:45:34 PM / by Alice Ancona posted in Trade Spotlight, April 2020

Begging forgiveness from Gabriel García Márquez, trade has recently gone through a rather extraordinary shift.

Covid-19 pandemic has been the ultimate disruptor for trade. We really can’t compare – apples to apples – with any other period in time.

Below are some highlights of year-to-date (YTD) data for Florida for February. March trade data will be released in a couple of weeks and will be very telling. Be sure to check back with us for a trade update when those figures come out.

For Feb YTD we are up in imports by 3% in value. Origin exports are up by 3.41% in value. Its important to note that China was closed for production and some of the products where we see an increase have been traditionally sourced from China.

Off the bat – top import and import percentage increase for Florida is organic chemicals which have medical, pharmaceutical, biochemical, or bioengineering applications. In Feb 2019 we imported $83.5M but in Feb 2020 we imported $1.59B about a 1,800% increase.

IMPORTS

Products | Feb 2019 vs Feb 2020:

| Notable decreases | Other notable increases |

| (Some of this is demand related. Another thing to keep in mind is that factories were closed in China so we could not source either)

|

73% increase in cereals 29% increase in edible preparations which include: yeasts, prepared baking powders, sauces and preparations, condiments, seasonings, soups, broths, ice cream 28% increase in milling products (products like starch and gluten used to make bread and baked goods, etc.) 26% increase in edible vegetables 21% increase in sugar and sugar confectionery |

Trading Partners | Feb 2019 vs Feb 2020:

| Up by 1,500% - Ireland is Florida’s 20th ranked import trade partner. This is unusual increase and likely COVID-19 related. Ireland exports pharmaceuticals and medical devices. Half of the world’s ventilators are made in Ireland. Notable increases are organic chemicals and iron or steel. |

|

| Up by 105% - UK is Florida’s 11th ranked import partner. This was also an unusual increase and likely COVID-19 related. UK is a producer of pharma, med-tech and medical devices. Notable increases are organic and inorganic chemicals and medicaments. |

|

| Up by 105.7% - Hungry. In value this not a huge leap from $23M to $47M and Hungry is not a top 50 import trade partner for Florida. This increase is unusual as its likely COVID-19 related. Hungary’s primary exports are Packaged Medicaments which are also known as medicine, antibiotics, penicillin, insulin, and other related items. |

|

| Up by 41% - Netherlands. The Netherlands is Florida’s 26th ranked import trading partner (not high ranked). This also likely COVID-19 related, notable increases are in fish and seafood and resins and other extracts which can be used in the production of medicaments |

|

| Up by 34.5% - Vietnam. Vietnam is Florida’s 12th ranked trading partner. They are an alternative manufacturing center to China so once Chinese factories were closed, we shifted to importing from Vietnam. Much of what we import is furniture, electric machinery and footwear. This is likely ordered from before and may also be attributed to tariffs imposed on certain products in China. |

|

| Down by 23.8% - China is our #1 source of imports (like many other states). Note that China was closed January and February and has recently restarted production. |

|

| Down by -18% - Japan - #2 ranked import partner for Florida. Top imports include automotive (vehicles and parts) and electronics. |

|

| Down by -46% - Brazil is Florida’s 3rd ranked import trading partner. Top imports are aircraft and aviation equipment. |

|

| Down by -22.7% - France – Florida’s 8th ranked import trading partner. Top imports include aircraft and aviation equipment. |

Florida Origin Exports TO THE WORLD

(products that Florida makes):

Products | Feb 2019 vs Feb 2020:

| Notable Increases: | Notable Decreases: |

| Up 140.9% - Live Animals Up 62.7% - Iron & steel Up 39% - Pharma Up 38.45% -Aircraft parts Up 26.7% - Inorganic Chemicals Up 17.8% - Beverages and spirits |

Down by 28% - Fertilizers Down by 21% - Arms & Munitions Down by 17% - Chemical Products Down by 14% - Ships & boats Down by 8.6% - Electrical Equipment |

Trading Partners | Feb 2019 vs Feb 2020:

| Up by 62.59% - Japan. Notable increases: 4,000% increase in fertilizer, 480% increase in paper and paperboard, 390% increase in boats and ships. |

|

| Up 50.46% - UK. Notable increases: 11,000% increase in seeds and plants, 1,800% increase in footwear, 600% increase in manufactured articles (such as household goods). |

|

| Up by 47% - Italy. Notable increases: 3,800% increase in fruits and vegetables, 3,000% increase in meat, 1,900% increase in woven fabrics. |

|

| Up by 44% - India. Notable increases: 12,000% increase in articles of leather, 10,000% increase in mineral oil, 2,400% increase in aircraft and aircraft parts. |

|

| Up by 29.78% - El Salvador. Notable increases: 1,700% increase in precious and semiprecious stones and metals, 800% increase in special woven fabrics. |

|

| Up by 364% - New Zealand (very unusual). Notable increases: 2,400% increase aircraft and aircraft parts, 1,400 % increase apparel, 600% increase in inorganic chemicals as well as articles of iron and steel, 334% increase pharmaceuticals. |

|

| Up by 178% - Egypt (very unusual) Notable increases: 4,500% increase in paper and paperboard, 3,700% increase in dairy products, 620% increase in electric machinery, 300% increase in Florida exports of medical equipment. |

Export markets that were down are:

| Down by 26% - China |

|

| Down by 22.8% - Paraguay | |

| Down by 24% - Argentina |

|

| Down by 14% - Mexico |

|

| Down by nearly 10% - Chile and Germany |

Re-thinking our medical equipment and pharma supply chains

Apr 21, 2020 8:49:12 AM / by Alice Ancona posted in Trade Spotlight, April 2020

The COVID-19 pandemic has made terms like PPE and N95 masks common household lingo. In the past few weeks, we have all learned a lot about things which we once took for granted.

Regardless of where anyone stands on the trade-war with China, COVID-19 has made it acutely clear that localizing or regionalizing supply chains for the medical equipment and pharma sector is vital and can save lives.

From a Miami and Florida standpoint, this is not science fiction, it is achievable.

Consider this: Florida is home to the nation’s:

- 2nd largest pharmaceuticals and medicine manufacturing industry

- 2nd largest medical device manufacturing industry

- 5th largest biotech R&D facilities

Many of these facilities are located here in Miami/South Florida.

We have a tremendous eco-system of companies that are best-in-class. These companies not only need our support today to weather this recession, they need investment in the sector to ensure that we can source and supply our community, the nation and the world.

Download Enterprise Florida’s Life Sciences Industry Brief here.

Opinion: The Floral Industry During COVID-19

Apr 21, 2020 8:44:50 AM / by Christine Boldt posted in Industry News, April 2020

|

During these unprecedented times, Christine Boldt hopes that people can understand the health benefits of flowers. Research shows that flowers can relieve stress, can make people feel better and can give one a better outlook on life if flowers are in their homes or workplace. |

Opinion: Post-Pandemic Challenges in International Trade Regulation and Compliance

Apr 21, 2020 8:42:20 AM / by Lee Sandler posted in Industry News, April 2020

This article was written two weeks before its publication, a very risky thing to do in these rapidly and radically changing times. Nonetheless, I will share a few thoughts on what I think we are learning in the COVID-19 environment and where we might go in future in a limited area that our firm has addressed for four decades: international trade regulation and compliance.

Supply Chain Options. Companies diversifying their supply chains may see an increased role for Latin American and African operations.

A highly publicized lesson from the Pandemic is that companies are at great risk if they are dependent upon one supplier and/or one country for its products, components or materials. The shut-down of Chinese factories and ports brought the press and business community to refocus intensively on issues long-talked about: over-dependence on China and movement of manufacturing away from the US.

Prior to the COVID-19 pandemic, supply chains had already begun to shift from China in response to the high tariffs placed on Chinese goods (15 to 25%) as well as increasing Chinese labor costs. Companies moved some or all of their production to other countries in the region (e.g., Vietnam, Cambodia, Laos, Malaysia, Bangladesh).

The Pandemic experience suggests that keeping all production in one “region” (ie., countries bound together by geography as well as interconnected economically and socially), may not sufficiently protect the company. Tariffs can target specific countries; viruses do not. Viruses are more likely to affect many countries within a “region” and less likely to affect (simultaneously) those in other “regions”.

In the post pandemic world, this new reality could be a springboard for more corporate interest in alternative sourcing and distribution based in Latin America and Africa. Of course, that opportunity is is challenged by the unknown: will late eruption and spread of the virus in Latin American and African countries dissuade decision-makers from considering those markets --- and the known: will those countries be able to convincingly demonstrate the stable economic, political and labor environments persuasive to corporate decision-makers.

Tariff and Revenue Policy. Protectionist measures --- high tariffs and Buy America requirements – will continue to grow and drive trade and revenue policy.

Those concepts dominated front page, network and internet discussions about the absence of sufficient PPE for US health care workers: the trade experts in the White House strongly stating that dependence on foreign products is the problem and that “Buy America” is the solution. They also overrode even a minimal relief proposal for importers: extending the due date to pay duty (not to reduce or cancel duty) for 90 days. While the Administration approved a 90-day delay for US taxpayers to pay our most significant revenue source (IRS taxes), it rejected a 90-day delay for US Importers to pay duties, a far less significant revenue source, saying that all duties should be paid timely despite the economic pressures of the pandemic. Before rejecting the delay, it also indicated that a 90-day delay would not be available to ease collection of the “trade war” tariffs (e.g.,anti-dumping, countervailing duties and the 10%, 15%, 25% and 50% duties on products like steel, aluminum, washing machines and virtually anything from China).

In the post pandemic world, will the policies for driving high tariffs remain a tool that smothers and overwhelms the economics of imports, or will we embrace policies encouraging two-way (fair) trade? It appears that protectionist concerns have new momentum and companies will revisit revenue saving programs: tariff reclassification, lowered dutiable values (including first sale appraisement programs), use of preferential programs, duty drawback, foreign-trade zones, bonded warehouses, etal.

Automation: Finally eliminating Paperwork. Our import/export processes are not nearly as well-automated as they need to be.

Original paperwork still needs to be physically presented and filed for too many import and export transactions, often affecting products that are sensitive to delays, and typically regulated by agencies like USDA, Fish & Wildlife – and not just CBP. Efforts to eliminate required paperwork temporarily or permanently – even in the COVID-19 environment --have failed, or been too slow, or have included too many exceptions.

In the post pandemic world, we have a great opportunity to totally (or substantially eliminate) those archaic 19th century requirements.

Automation: Make it Automatic. Our automated systems are not flexible enough to accommodate timely (much less immediate) changes.

Decisions to grant exclusions from the high tariffs (e.g., 25% on Chinese goods) require CBP computers to be reprogrammed to issue refunds of past payments and to accept new importations without depositing the 25% duty. As a result, importers thinking they had been granted “relief” were required to wait months to get refunds, and even more egregiously, were required to deposit the 25% duty on new entries ….. with no specific timetable for refunds. Similarly, some industry experts estimated computer programming for the proposal of a 90-day delay in duty payments would take at least 60 days to implement, eroding if not devastating the intended benefits. The painful, costly and lengthy processes required to obtain or implement relief might be bearable in good economic times, but are unbearable when corporate survival is at stake.

In the post pandemic world, we will have great motivation and experience to revolutionize automation, allowing relief efforts to truly provide relief (as well as new enforcement efforts to provide true enforcement).

Information for the Trade. We are not nearly as well informed as we need to be about the regulations that govern our imports and exports.

Regulations are changed daily by over forty (40) federal executive branch agencies, Congress, federal and state courts and -- most recently -- Executive orders and Presidential tweets. How can anyone efficiently, timely and reliably find the information needed to comply with the law or take advantage of incentives?

Information is available today, if we can find it reported somewhere in the huge volume of public of varying origin, scope, timeliness and reliability. Businesses cannot begin each day by checking each of the official sources, nor can they check (and validate) the huge variety of unofficial sources that have exploded on the internet with its overwhelming and confusing variety of offerings by data-based companies, service providers, associations, bloggers, etc. We are all challenged to determine if our sources are complete or incomplete; factual or interpretative; timely/late/out-of-date; true or fake?

Websites. In the current environment, many websites provide basic information on the new developments coupled with links to the official documents. World Trade Center Miami recently moved significantly in that direction on its website, providing COVID-19 Alerts, Resource Links and Small Biz info to its website. www.worldtrade.org. Our firm provides similar one-stop website services on Tariff Resources (information and deadlines on all US tariff increases and retaliatory tariffs by other nations on US exports during the Trump Presidency) and a “COVID-19 Trade Impact Resource” page. www.strtrade.com. These two websites that complement the thousands of others that businesses are able to navigate in search of the information which directly affects them.

Electronic Newsletters. Newsletters issued on a daily basis pop into inboxes, with information of President Trump tweeted on a Friday that duty on Turkish steel would increase from 25% to 50% effective on the following Monday. Our firm for decades has issued a newsletter on import/export regulatory issues (delivered first by snail mail, then by fax and now by email to 30,000 subscribers). Each business has increasing needs for that immediate information, and must find reliable, timely sources for the information pertinent to their businesses.

In the post pandemic world, will we seize the opportunity to develop information systems which bring relevant and accurate information to affected businesses in a timely and reliable way, and create reliable ways to navigate the internet sources as they continue to multiply.

Information within the Government. Federal agencies have information problems as well. The agency that creates a new rule (USDA FDA, CPSC, FEMA, etc) often doesn’t involve or inform the agency that enforces it (CBP). Most recently (in response to COVID-19) FEMA adopted, effectively immediately, new rules prohibiting export of certain medical supplies described in a way that CBP could not use its existing automated information systems to identify shipments with the prohibited goods, but would be required to detain, inspect and delay the export of a broad range of legitimate exports. The rule was developed with good intentions, but without good intra-government communications needed for effective and efficient implementation.

In the post pandemic world, will we infuse our policy decisions with the intelligence of the operational experts to assure that we adopt programs that can be implemented and allow them to be developed and implemented successfully.

The Pandemic has forced us to rethink our lives and businesses. Hopefully those thoughts will evolve into actions creating positive improvements from this shared, historic and shattering experience.

For heavily trade-dependent locales like South Florida, COVID-19 has been devastating. The state’s $154 billion in merchandise trade (along with $86 billion in tourism) will quickly become relics of the past. Our major trading partners in Latin America and the Caribbean have yet to feel the brunt of the Coronavirus but are expected to see regional GDP contract by nearly 2%, although that is a conservative estimate.

Opinion: Supply Chain is The Lifeblood for Trade and Commerce

Apr 21, 2020 8:24:41 AM / by Jerry Haar posted in Industry News, April 2020

For heavily trade-dependent locales like South Florida, COVID-19 has been devastating. The state’s $154 billion in merchandise trade (along with $86 billion in tourism) will quickly become relics of the past. Our major trading partners in Latin America and the Caribbean have yet to feel the brunt of the Coronavirus but are expected to see regional GDP contract by nearly 2%, although that is a conservative estimate.

Coronavirus has disrupted supply chains for nearly 75% of US companies

Apr 20, 2020 2:52:01 PM / by Axios posted in Industry News, April 2020

Data show global production out of China fell to an all-time low last month, with freight and shipping slowing dramatically as the virus has shuttered factories and container ports. Of the companies surveyed that expect supply chain impacts, most expect the severity of the disruptions will increase after the first quarter of this year.