Unprecedented conditions require remarkable responses from all of us. I see decisions being made in our community that put the welfare of people and community first. That is inspiring!

Message from Our President

Apr 23, 2020 6:33:32 AM / by Ivan Barrios posted in April 2020, President's Message

Virus Disrupts Miami Areas International Trade and Supply Systems

Apr 21, 2020 4:59:17 PM / by Miami Herald posted in Trade Spotlight, April 2020

"Commercial airlines have radically reduced passenger flights, but passenger planes that are still flying also carry freight, as they normally do. Also, air freight traffic through MIA is very active."

- Ivan Barrios, President & CEO, World Trade Center Miami

Floral industry upended, Miami's global trade bedridden

Apr 21, 2020 4:44:31 PM / by Miami Today posted in Trade Spotlight, April 2020

“Manufacturers and shippers are going to increasingly focus on products that are in need, saying “some manufacturers are either going to voluntarily shift, or the government is going to ask them to shift.”

Opinion: The Floral Industry During COVID-19

Apr 21, 2020 4:37:29 PM / by Christine Boldt posted in Industry News, Opinion, April 2020

During this unprecedented time of stay at home orders the Association of Floral Importers of Florida (AFIF) is hoping that people can understand the health benefits of flowers. Research shows that flowers can relieve stress, can make people feel better and can give one a better outlook on life if flowers are in their homes or workplace.

Flowers are available, they are in most of the stores that are open and consumers can brighten someone’s day by having flowers delivered to whomever they are thinking of, can bring some flowers home to enhance their homes and or can leave flowers on someone’s doorstep to say “thank you” or “thinking of you” in this time of social distancing.

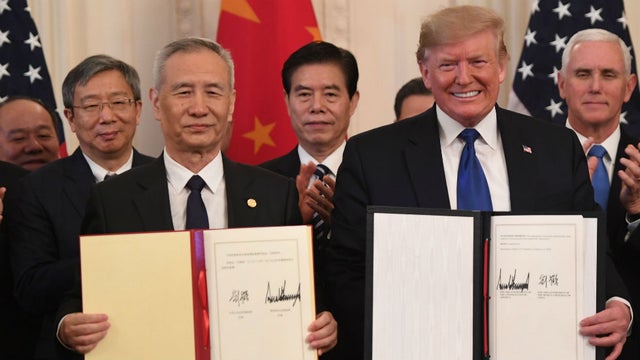

Coronavirus outbreak may force US, China to rework trade deal implementation

Apr 21, 2020 4:35:43 PM / by The Hill posted in Industry News, April 2020

Several weeks have passed since the U.S.-China Phase One trade agreement entered into force, but already there is good news on implementation. China has taken the actions specified in the agreement according to required time frames, and in some cases has even been ahead of schedule.

Beijing has relaxed import restrictions on agricultural products ranging from potatoes to poultry to pet food, has granted approval for a U.S. electronic payments provider to operate in China after several previous delays and has issued exceptions to tariff increases on certain U.S. imports, including certain pork, beef, soybeans and energy products.

China has accomplished this while confronting a national health emergency, the COVID-19 virus. Even with the attention of senior Chinese officials focused on dealing with the health crisis, and some government workers staying at home, China has demonstrated that it is taking implementation of this bilateral deal seriously.

The next notable milestone is... (Read more)

Warehousing sector well-positioned to weather coronavirus disruption, report finds

Apr 21, 2020 4:33:09 PM / by Supply Chain Dive posted in Industry News, April 2020

The logistics real estate sector could be among the best positioned to handle inventory supply and demand disruptions from the COVID-19 outbreak due to standard long-term occupancy contracts and a potential shift to more regional supply chains in the future, according to a report from Prologis released in March.

The logistics real estate sector could be among the best positioned to handle inventory supply and demand disruptions from the COVID-19 outbreak due to standard long-term occupancy contracts and a potential shift to more regional supply chains in the future, according to a report from Prologis released in March.Opinion: Post-Pandemic Challenges in International Trade Regulation and Compliance

Apr 21, 2020 4:28:35 PM / by Lee Sandler posted in Industry News, Opinion, April 2020

This article was written two weeks before its publication, a very risky thing to do in these rapidly and radically changing times. Nonetheless, I will share a few thoughts on what I think we are learning in the COVID-19 environment and where we might go in future in a limited area that our firm has addressed for four decades: international trade regulation and compliance.

Supply Chain Options. Companies diversifying their supply chains may see an increased role for Latin American and African operations.

A highly publicized lesson from the Pandemic is that companies are at great risk if they are dependent upon one supplier and/or one country for its products, components or materials. The shut-down of Chinese factories and ports brought the press and business community to refocus intensively on issues long-talked about: over-dependence on China and movement of manufacturing away from the US.

Prior to the COVID-19 pandemic, supply chains had already begun to shift from China in response to the high tariffs placed on Chinese goods (15 to 25%) as well as increasing Chinese labor costs. Companies moved some or all of their production to other countries in the region (e.g., Vietnam, Cambodia, Laos, Malaysia, Bangladesh).

The Pandemic experience suggests that keeping all production in one “region” (ie., countries bound together by geography as well as interconnected economically and socially), may not sufficiently protect the company. Tariffs can target specific countries; viruses do not. Viruses are more likely to affect many countries within a “region” and less likely to affect (simultaneously) those in other “regions”.

In the post pandemic world, this new reality could be a springboard for more corporate interest in alternative sourcing and distribution based in Latin America and Africa. Of course, that opportunity is is challenged by the unknown: will late eruption and spread of the virus in Latin American and African countries dissuade decision-makers from considering those markets --- and the known: will those countries be able to convincingly demonstrate the stable economic, political and labor environments persuasive to corporate decision-makers.

Tariff and Revenue Policy. Protectionist measures --- high tariffs and Buy America requirements – will continue to grow and drive trade and revenue policy.

Those concepts dominated front page, network and internet discussions about the absence of sufficient PPE for US health care workers: the trade experts in the White House strongly stating that dependence on foreign products is the problem and that “Buy America” is the solution. They also overrode even a minimal relief proposal for importers: extending the due date to pay duty (not to reduce or cancel duty) for 90 days. While the Administration approved a 90-day delay for US taxpayers to pay our most significant revenue source (IRS taxes), it rejected a 90-day delay for US Importers to pay duties, a far less significant revenue source, saying that all duties should be paid timely despite the economic pressures of the pandemic. Before rejecting the delay, it also indicated that a 90-day delay would not be available to ease collection of the “trade war” tariffs (e.g.,anti-dumping, countervailing duties and the 10%, 15%, 25% and 50% duties on products like steel, aluminum, washing machines and virtually anything from China).

In the post pandemic world, will the policies for driving high tariffs remain a tool that smothers and overwhelms the economics of imports, or will we embrace policies encouraging two-way (fair) trade? It appears that protectionist concerns have new momentum and companies will revisit revenue saving programs: tariff reclassification, lowered dutiable values (including first sale appraisement programs), use of preferential programs, duty drawback, foreign-trade zones, bonded warehouses, etal.

Automation: Finally eliminating Paperwork. Our import/export processes are not nearly as well-automated as they need to be.

Original paperwork still needs to be physically presented and filed for too many import and export transactions, often affecting products that are sensitive to delays, and typically regulated by agencies like USDA, Fish & Wildlife – and not just CBP. Efforts to eliminate required paperwork temporarily or permanently – even in the COVID-19 environment --have failed, or been too slow, or have included too many exceptions.

In the post pandemic world, we have a great opportunity to totally (or substantially eliminate) those archaic 19th century requirements.

Automation: Make it Automatic. Our automated systems are not flexible enough to accommodate timely (much less immediate) changes.

Decisions to grant exclusions from the high tariffs (e.g., 25% on Chinese goods) require CBP computers to be reprogrammed to issue refunds of past payments and to accept new importations without depositing the 25% duty. As a result, importers thinking they had been granted “relief” were required to wait months to get refunds, and even more egregiously, were required to deposit the 25% duty on new entries ….. with no specific timetable for refunds. Similarly, some industry experts estimated computer programming for the proposal of a 90-day delay in duty payments would take at least 60 days to implement, eroding if not devastating the intended benefits. The painful, costly and lengthy processes required to obtain or implement relief might be bearable in good economic times, but are unbearable when corporate survival is at stake.

In the post pandemic world, we will have great motivation and experience to revolutionize automation, allowing relief efforts to truly provide relief (as well as new enforcement efforts to provide true enforcement).

Information for the Trade. We are not nearly as well informed as we need to be about the regulations that govern our imports and exports.

Regulations are changed daily by over forty (40) federal executive branch agencies, Congress, federal and state courts and -- most recently -- Executive orders and Presidential tweets. How can anyone efficiently, timely and reliably find the information needed to comply with the law or take advantage of incentives?

Information is available today, if we can find it reported somewhere in the huge volume of public of varying origin, scope, timeliness and reliability. Businesses cannot begin each day by checking each of the official sources, nor can they check (and validate) the huge variety of unofficial sources that have exploded on the internet with its overwhelming and confusing variety of offerings by data-based companies, service providers, associations, bloggers, etc. We are all challenged to determine if our sources are complete or incomplete; factual or interpretative; timely/late/out-of-date; true or fake?

Websites. In the current environment, many websites provide basic information on the new developments coupled with links to the official documents. World Trade Center Miami recently moved significantly in that direction on its website, providing COVID-19 Alerts, Resource Links and Small Biz info to its website. www.worldtrade.org. Our firm provides similar one-stop website services on Tariff Resources (information and deadlines on all US tariff increases and retaliatory tariffs by other nations on

Opinion: Supply Chain is The Lifeblood for Trade and Commerce

Apr 21, 2020 4:22:42 PM / by Jerry Haar posted in Industry News, Opinion, April 2020

For heavily trade-dependent locales like South Florida, COVID-19 has been devastating. The state’s $154 billion in merchandise trade (along with $86 billion in tourism) will quickly become relics of the past. Our major trading partners in Latin America and the Caribbean have yet to feel the brunt of the Coronavirus but are expected to see regional GDP contract by nearly 2%, although that is a conservative estimate.

Global trade impact of the Coronavirus

Apr 21, 2020 4:18:27 PM / by UNCTAD posted in Industry News, April 2020

Besides its worrying effects on human life, the novel strain of COVID-19 has the potential to significantly slowdown not only the Chinese economy but also the global economy. China has become the central manufacturing hub of many global business operations. Any disruption of China’s output is expected to have repercussions elsewhere through regional and global value chains.

Indeed, most recent data from China indicate a substantial decline in output. China

Manufacturing Purchasing Manager’s Index (PMI), a critical production index, fell by about

22 points in February (Figure 1a). This index is highly correlated with exports and such a

decline implies a reduction in exports of about 2 percent on an annualized basis. In other

words, the drop observed in February spread over the year is equivalent to -2 percent of the

supply of intermediate goods. Indicators on shipping also suggest a reduction in Chinese

exports for the month of February (Read more)

Covid-19 is altering the world of logistics

Apr 21, 2020 4:04:00 PM / by Gulf News posted in Industry News, April 2020

The rapid spread of COVID-19 presents significant challenges around the world. In addition to the human impact, there is a considerable commercial effect being felt. Governments have adopted a wide range of containment measures, some of which have resulted in the shutdown of manufacturing, as well as labor disruption through enforced isolation, travel bans and border controls across the world. There is potential for a significant dent to global consumption and more.